Basic Policy

Invincible Investment Corporation ("INV") , making focused investments in hotels and residential properties as Core Assets, shall manage its assets in an aim to guarantee sound growth of its assets and secure stable profits over the medium and long term.

1. Selection Policy for Investment Targets by Property Type

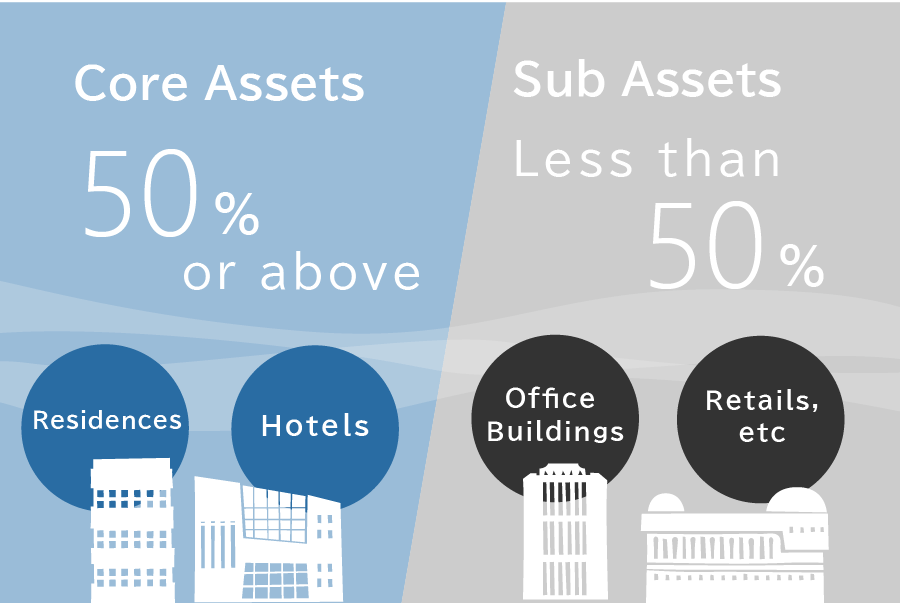

- INV will make investment primarily in hotels or residential properties, or Real Estate Assets and Other Assets backed by such hotels or residential properties and Real Estate-Backed Securities (= "Core Assets")

- INV will also make investment in properties used for purposes other than hotels, residences or Real Estate Assets backed by such hotels or non-residential properties(= "Sub Assets")

- Allocation ratio for Core Assets should be 50% or above

2. Selection Policy for Investment Targets by Geography

- INV's primary target regions for investment are the greater Tokyo area (Tokyo and Kanagawa, Chiba, and Saitama prefectures) and ordinance designated cities. Target regions further include major cities and surrounding areas nationwide and overseas to ensure flexibility in the pursuit of investment opportunities

- In order to secure sound growth of investment assets and stable profits over the medium and long term, INV aims to construct a geographically diverse portfolio of investment assets by avoiding the risk of economic fluctuations in certain regions as well as avoiding concentrated investment in certain areas to diversify earthquake and other risks

- Regarding overseas assets, INV currently plans to invest only in hotel properties. Also, INV's overseas investment targets will only include countries and territories that fulfill the requirements specified in Article 24-2 of the Rules on Real Estate Investment Trusts and Real Estate Investment Corporations prescribed by The Investment Trusts Association of Japan

| Area | Specific Area | Allocation Ratio (based on acquisition value) |

|

|---|---|---|---|

| Overall allocation ratio | Allocation ratio among domestic assets excluding domestic hotels | ||

| Greater Tokyo Area | Tokyo and Kanagawa, Chiba and Saitama Prefectures | 85% or more | 70% or more |

| Major Regional Cities | Areas surrounding the greater Tokyo area and major cities nationwide including ordinance designated cities | less than 30% | |

| Overseas | Countries and regions in North America, Europe and Asia with stable political, economic and financial systems, in which transparency of legal, accounting and taxation procedures and real estate markets, etc. is ensured, as well as other equivalent countries and regions (e.g., the United States of America, Canada, Great Britain, The British Cayman Islands and Singapore) | less than 15% * | -- |

- Acquisition price of overseas properties will be converted into JPY amount based on the exchange rate as of the time of investment. (If INV hedge risk of foreign exchange forward etc., based on after the hedging transaction.)